Good Advice On Selecting Forex Trading Websites

Wiki Article

Tips For Trading In Forex: 10 Ways To Reduce The Risk

Forex trading success is dependent on how you manage your risk. Here are the top 10 ways to manage risk to protect your trading capital and reduce the risk of losses.

Create Stop Loss Orders for every Trade

1. Stop-loss trading orders end the trade when the market price is at the specified level, thus limiting any potential losses. Stop-loss orders ensure that you do not be able to lose more money than your budget will allow if you are trading against yourself. When you first open your trade, place the limit order.

2. Define Risk per Trade

Limit the amount that you risk for each trade, which is usually set in no greater than 1-2% of your account balance. You can remain in the market for stocks during a losing streak and not risk having your account wiped out.

3. Use Proper Position Sizing

The size of your position is the quantity of money you trade or buy in a particular trade. It is possible to adjust the size of your position according to the size of your trading account, your trade's risks and limit loss. If, for instance, you have a larger stop-loss than your position size, the size must be reduced to ensure an even risk level.

4. Avoid Over-Leveraging

High leverage boosts both profit and loss. Brokers typically offer higher levels of leverage to beginners however they should opt for moderate leverage. Because high leverage could quickly wipe out your account when trades are against you, it's better to start with a smaller amount (1:10 or lower) and gain the experience.

5. Diversify Your Trades

Don't put all your capital into one currency pair or trade. Diversifying your trading between different timeframes and pairs reduces the risk of losing funds due to unexpected events that impact one pair or segment. Beware of excessive diversification. It could dilute your focus, and leave you spread too thin.

6. Set up an Investment Plan including Risk Limits

It is possible to maintain the discipline of trading by creating a strategy with rules that define entry, exit, and risk tolerance. Set weekly and daily risk limits. For example, do not take on more than 5% per day of your account. Take a break when you've reached your limit. Don't keep trading because of anger or frustration.

7. Utilize trailing stops to lock in profit

A dynamic stop-loss, a trailing stop, changes in accordance with the progress of your trade. You can capture profits in the case of a market reverse and still allow your trade to expand if it is moving in a positive direction. It's a good way to protect profits without closing the position too soon.

8. Control Emotions and Avoid Revenge Control Emotions and Avoid Revenge

Emotional trading can lead to inadequate decision-making and risky trading. The combination of greed, fear, and frustration can drive traders to make impulsive decisions or take on more risk than you planned. Avoid revenge trading, or trying to recover losses with one trade after a losing trade. Stay with your strategy and reduce risk to avoid escalating losses.

9. Avoid Trading During High-Impact News Events

The impact of news events that are high-profile such as central bank decisions or economic news, can trigger extreme volatility in markets. If you are new to trading news, it is best to avoid trading or close positions prior to and following major announcements. Price fluctuations could lead to unexpected loss.

10. Keep a Trading Journal in order to review your trading mistakes

Keep a diary to learn from your wins and losses. Record details about each trade, such as the reason why you entered, the risk, stop-loss placement and the result. You can increase your risk control by periodically review your trading journal.

Forex trading involves an extensive amount of risk management. It is essential to recognize lucrative opportunities and managing your risk. By following these guidelines, you protect your capital, reduce loss, and develop a long-term strategy for trading. Have a look at the best https://th.roboforex.com/ for site info including best forex broker trading platform, forex best trading app, foreign exchange trading platform, platform for trading forex, forex exchange platform, best currency brokers, best forex broker in usa, forex broker platform, forex trading forex, broker cfd and more.

The Top 10 Tips To Keep In Mind When Trading Online Forex: Technical And Fundamental Analysis

Both technical and fundamental analysis are essential to Forex trading. They can assist you in making better decisions. Here are the top 10 suggestions to help you use Fundamental and Technical Analysis to your online Forex trading.

1. Find out the main levels of resistance and support

Zones of support and resistance are price zones in which a currency pair often pauses or reverses. These levels are psychological obstacles and therefore essential to planning entry and exit strategies. It is crucial to be able to recognize these zones to know how the market will turn or begin to break out.

2. Multi-timeframes give you more perspective

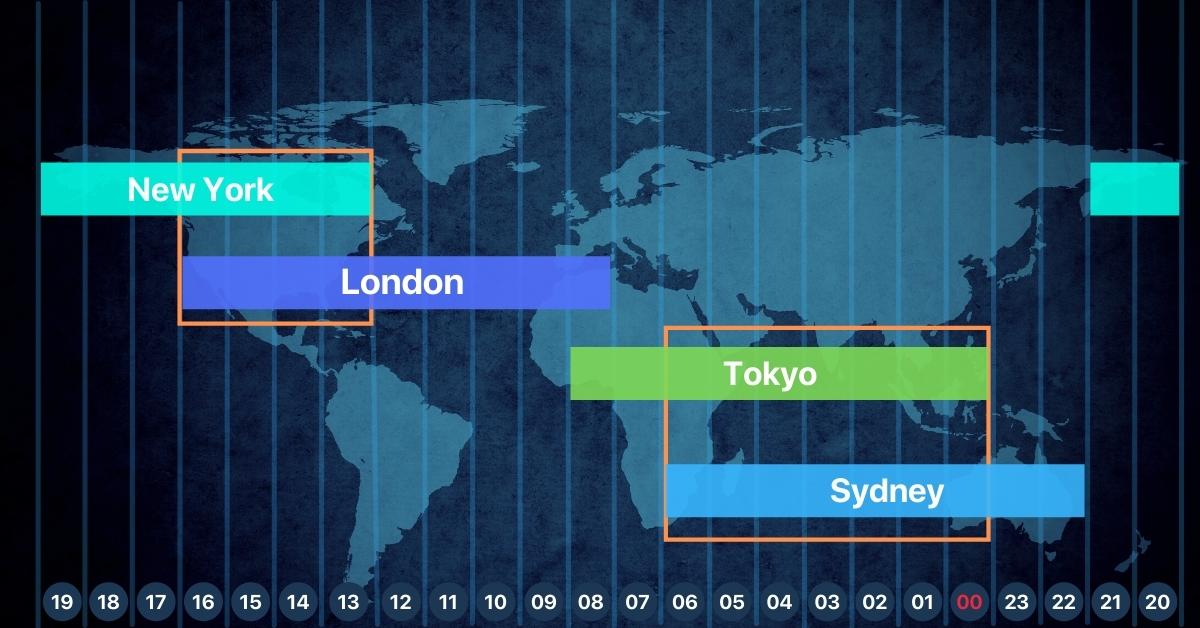

The ability to analyze charts at different timeframes - such as daily and 4-hour charts - will provide you with an understanding of longer and shorter term trends. While higher timeframes can be an excellent indicator of overall trends, lower timeframes can give more precise timing and entry points.

3. Master Key Technical Indicators

The most important indicators to use that are essential to Forex trading include moving averages and the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD). It is possible to improve your analysis by understanding the functions of each indicator and then combining them.

4. Candlestick patterns are a good indicator of candlestick patterns

Candlestick patterns like doji, Hammer, and engulfing patterns often signal potential reversals or continuations. You can recognize price movement changes by becoming familiar with these patterns. Combining candlestick analysis with other tools, like support/resistance, can improve the accuracy of your trades.

5. Trend analysis can give directional indications

Use trendlines and moving averages to determine uptrends, downtrends or market movements that are sideways. Trend-following is a common strategy in Forex trading because trading in the direction of the trend often provides more consistent outcomes. Avoid trading in the counter-trend direction unless you are at a high level of expertise.

Fundamental Analysis Tips

6. Understand Central Bank policies and interest Rates

Central banks control interest rates. This directly impacts currency values. Higher interest rates tend to increase the strength of the currency. However, lower interest rates could weaken the currency. Make sure you keep track of any central bank announcements as they can often cause significant market movements.

7. Pay attention to economic indicators and reports.

The most important indicators of economic health, such as economy's GDP, unemployment rate consumer confidence, inflation and consumer sentiment provide an insight into the economy of the country and affect the currency's value. To keep up-to-date with the latest releases, you can use an economic calendar to keep track of the effects of these indicators on your currency pairs.

8. Geopolitical Events and News: Study them

Political events, such as elections, trade negotiations, or conflicts, could affect the markets for currency. Stay up-to-date on the latest global news and events in particular those that impact important economies, such as the United States, Eurozone, China. Sudden geopolitical shifts can lead to volatility, so be prepared to adapt your strategy accordingly.

Combining Technical and Fundamental Analysis

9. Aligning the technical signals to fundamental Events

Combining the technical analysis with fundamental analysis will help improve your decision making. If a technical setup displays an uptrend when paired with an economic forecast that is positive This can result in more of a positive signal to buy. Aligning both approaches helps decrease uncertainty and increases the likelihood of successful trading.

10. Trade Risky Events

The volatility that is caused by events with high impact, like Federal Reserve meetings or the release of non-farm payments (NFP) could result in dramatic changes in prices. Because of their unpredictable nature most traders avoid trading during these periods. If you've been through it however, you are able to capitalize on the price movements through analytical techniques. You must be cautious and put in place tight stop-loss limits.

Forex trading involves a mixture of analytical and technical analysis. This helps traders gain complete understanding of how market moves. Through mastering this method, traders can navigate market conditions better, take more strategic decision, and improve the performance of their business. See the best https://th.roboforex.com/about/client/faq/top10/ for website tips including forex and trading, app forex trading, top forex brokers, forex demo account, forex trading forex trading, currency trading demo account, top forex brokers, app forex trading, fx trading forex, forex trading trading and more.

The Top 10 Trading Platform And Technology Tips For Forex Online Trading

1. Forex trading requires that you choose the right platform to trade and fully understand the technology. We have compiled our top 10 tips on how to use technology and trading platforms to enhance your experience.

Choose a User Friendly Platform

Opt for an application that is simple and easy to navigate. You must be able to easily access charts and manage your positions as well as make orders. MetaTrader 4 (MT4) and MetaTrader 5 are popular platforms because they have a easy-to-use and flexible interface.

2. You will require a high-speed internet connection.

Fast and reliable internet is crucial for trading forex. A slow or unstable connection can lead to delayed order execution or missed opportunities as well as slippage. If you are experiencing connectivity problems upgrade your internet service or using Virtual Private Servers (VPS) can help to maintain a stable connection.

3. Speed of Test Order Execution

Speedy order processing is essential particularly if day trading or scalping are your main activities. Platforms that execute orders quickly limit slippage and enable traders to trade and then exit them at the prices intended. Test the platform speed using a demo account before you decide to sign up for a real one.

4. Explore Charting and Analysis Tools

A reliable trading platform must have advanced charting and analysis tools. Look for platforms with customizable charts, the ability to connect multiple indicators and the ability to conduct an in-depth analysis. This will allow you to make better informed choices about trading.

5. Check mobile trading capabilities

Mobile trading apps provide flexibility to manage and monitor trades while on the move. You should ensure that the platform you use has an efficient app with the features you require, such as charting and trade execution.

6. Automated Trading is a great alternative

A lot of traders employ algorithms or automated trading strategies to improve the consistency of their trading and decrease manual effort. If you are looking to automatize your trading, choose an online trading platform that is compatible with EAs (expert advisors) or bots. MT4/MT5 is compatible with a wide range of automated trading software.

7. Verify the security features

Online trading requires a secure and high-security system. Choose a platform that uses encryption protocols, two-factor authentication (copyright) as well as other security features to safeguard your funds and data. Be careful with platforms without robust security features as they can expose you to cyber-attacks.

8. Get Real-Time News and Data

In order to make the right trading decisions It is essential to get real-time updates on price and economic news. A good trading platform should incorporate reliable news feeds, as well as reliable market data. It keeps you updated on important market events that could affect the trading of your portfolio.

9. Check compatibility with your trading style

Different platforms suit different trading styles. For example, platforms that allow one-click trading and fast execution are perfect for scalpers, as are those that provide large charting and analysis tools are more suitable for traders who prefer swing trading. Make sure the platform is compatible with the specific needs of your trading strategy.

10. Test Customer Support and Platform Reliability

It is essential to establish a trustworthy customer support team, especially if there are issues with your system or need technical assistance. You can test the expertise of and speed of response of the support staff by contacting them with questions. Check the platform stability and uptime. In the event of a crash or downtime, it is likely to affect your trading.

If you choose the right platform with your needs and gaining an understanding of the technical aspect of it, you will be able to improve your trading efficiency. You will also be better prepared to handle market volatility. It is important to prioritize usability and security and specific tools to support your trading. See the recommended https://th.roboforex.com/about/client/security-policy/ for more recommendations including foreign exchange trading online, best forex trading platform, regulated forex brokers, forex trading forex, united states forex brokers, best forex trading broker, broker cfd, foreign exchange trading platform, forex trading brokers list, broker forex usa and more.